Alphabet Inc The $2 Trillion Milestone and AI Dominance

Introduction

In a remarkable feat, Alphabet Inc., the parent company of Google, recently crossed the $2 trillion market capitalization mark. This achievement solidifies Alphabet’s position as a global technology powerhouse. Let’s explore how Alphabet reached this milestone and the role of artificial intelligence (AI) in its success.

The Journey to $2 Trillion

Alphabet’s ascent to the $2 trillion club has been both impressive and tumultuous. Here are the key factors that contributed to this remarkable achievement:

- Earnings Report and Cloud Strength:

- Alphabet’s stock surged by 10% in a single day, reaching $171.95 per share. This substantial jump, the largest since July 2015, pushed the company’s valuation to $2.15 trillion.

- The catalyst behind this surge was Alphabet’s robust earnings report. The strength of its cloud-computing unit, fueled by AI-driven demand, played a pivotal role.

- Investors were reassured by Alphabet’s introduction of a dividend and a $70 billion share buyback program.

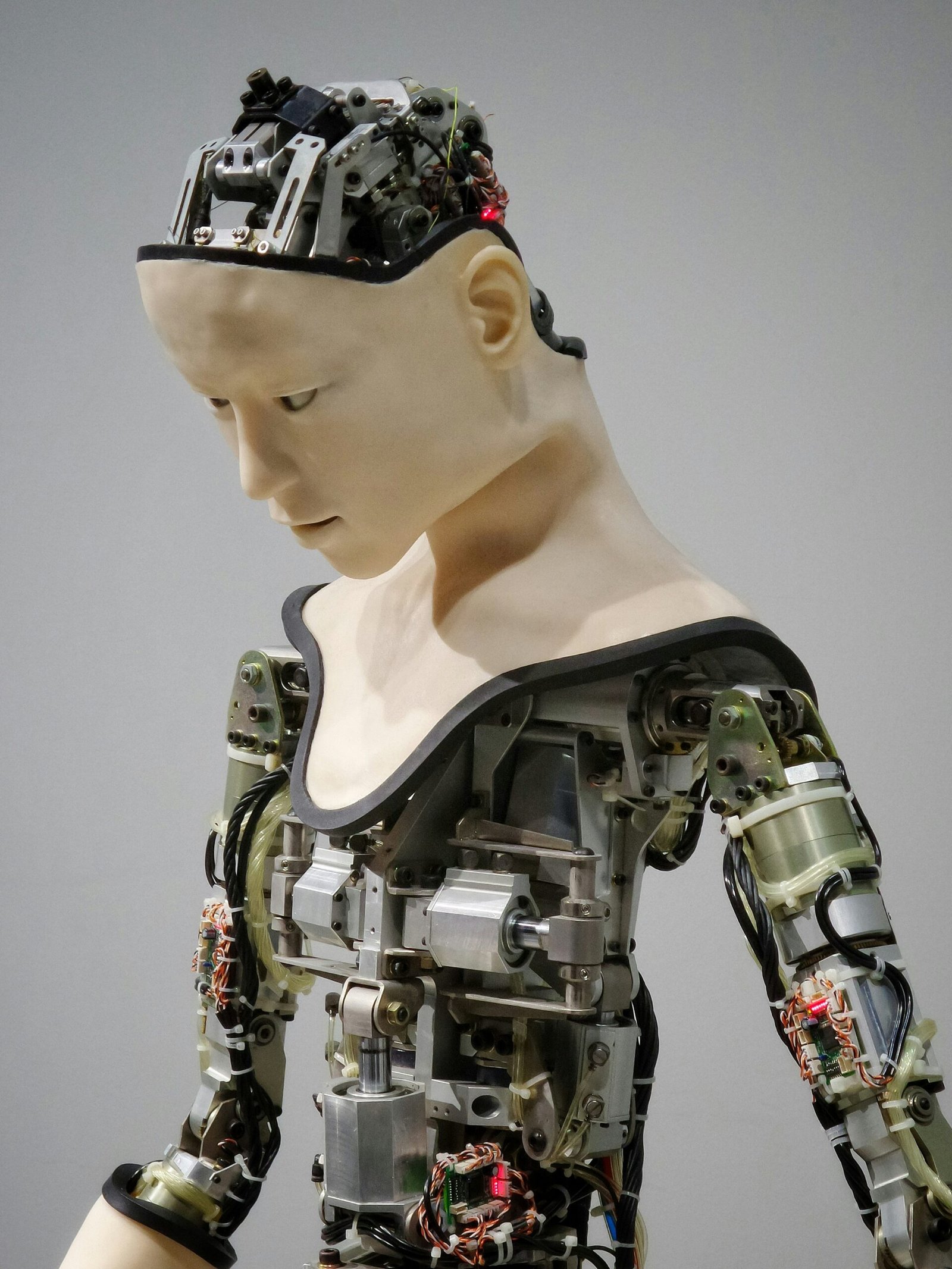

- AI and Innovation:

- Alphabet’s commitment to research and development has been unwavering. Its massive R&D budget allows for continuous innovation.

- The company’s AI initiatives have been particularly influential. From Google Search algorithms to self-driving cars, Alphabet’s AI-powered solutions have transformed industries.

- Rarefied Territory:

- Alphabet joins an exclusive club of $2 trillion market cap companies. Only Apple Inc., Microsoft Corp, Saudi Aramco, and Nvidia Corp. have surpassed this threshold.

- Nvidia, driven by the demand for its AI chips, achieved the milestone earlier this year. Amazon.com Inc. is also close to the $2 trillion mark.

- Challenges and Resilience:

- Alphabet faced criticism regarding its AI offerings, but its resilience and strategic focus paid off.

- Despite competition from firms like OpenAI, Alphabet’s well-managed operations, massive free cash flow, and commitment to AI make it a formidable player.

The Future of Alphabet

As Alphabet continues its journey, several factors will shape its trajectory:

- AI Leadership:

- Alphabet’s AI prowess positions it well for future growth. The race for the best AI products remains intense, but Alphabet’s resources and expertise give it a competitive edge.

- Valuation and Bargain Status:

- Shares trade at around 23.5 times estimated earnings, making Alphabet one of the cheapest among the so-called Magnificent Seven tech giants.

- The stock’s discount to the Nasdaq 100 and its modest premium above its 10-year average multiple suggest it may still be undervalued.

- Analyst Confidence:

- Wall Street analysts remain bullish on Alphabet, with nearly 85% recommending a “buy.”

- Double-digit growth in earnings and revenue is expected through 2026.

In conclusion, Alphabet’s journey to $2 trillion exemplifies its resilience, innovation, and AI leadership. As it continues to shape the tech landscape, investors and tech enthusiasts alike will closely watch its next moves.