Cryptocurrencies and Blockchain: The Future of Digital Finance

Introduction

Cryptocurrencies and blockchain technology have disrupted traditional financial systems, offering new possibilities for secure transactions, decentralized networks, and financial inclusion. In this comprehensive blog post, we’ll delve into the intricacies of these transformative technologies and their impact on the global economy.

What are Cryptocurrencies?

Cryptocurrencies are digital or virtual currencies that use cryptography for security. Unlike traditional fiat currencies (such as the US dollar or euro), cryptocurrencies operate on decentralized networks, making them resistant to government control and censorship.

Popular Cryptocurrencies

- Bitcoin (BTC): The pioneer of cryptocurrencies, Bitcoin was created by an anonymous person (or group) known as Satoshi Nakamoto. It serves as both a store of value and a medium of exchange. Its limited supply (21 million coins) adds to its scarcity and appeal.

- Ethereum (ETH): Beyond being a cryptocurrency, Ethereum introduced the concept of smart contracts. These self-executing contracts enable decentralized applications (DApps) to run on its blockchain. Ethereum’s versatility has led to a vibrant ecosystem of tokens and projects.

- Ripple (XRP): Designed for fast and low-cost cross-border payments, Ripple aims to revolutionize the remittance industry. Its focus on partnerships with financial institutions sets it apart.

The Blockchain Revolution

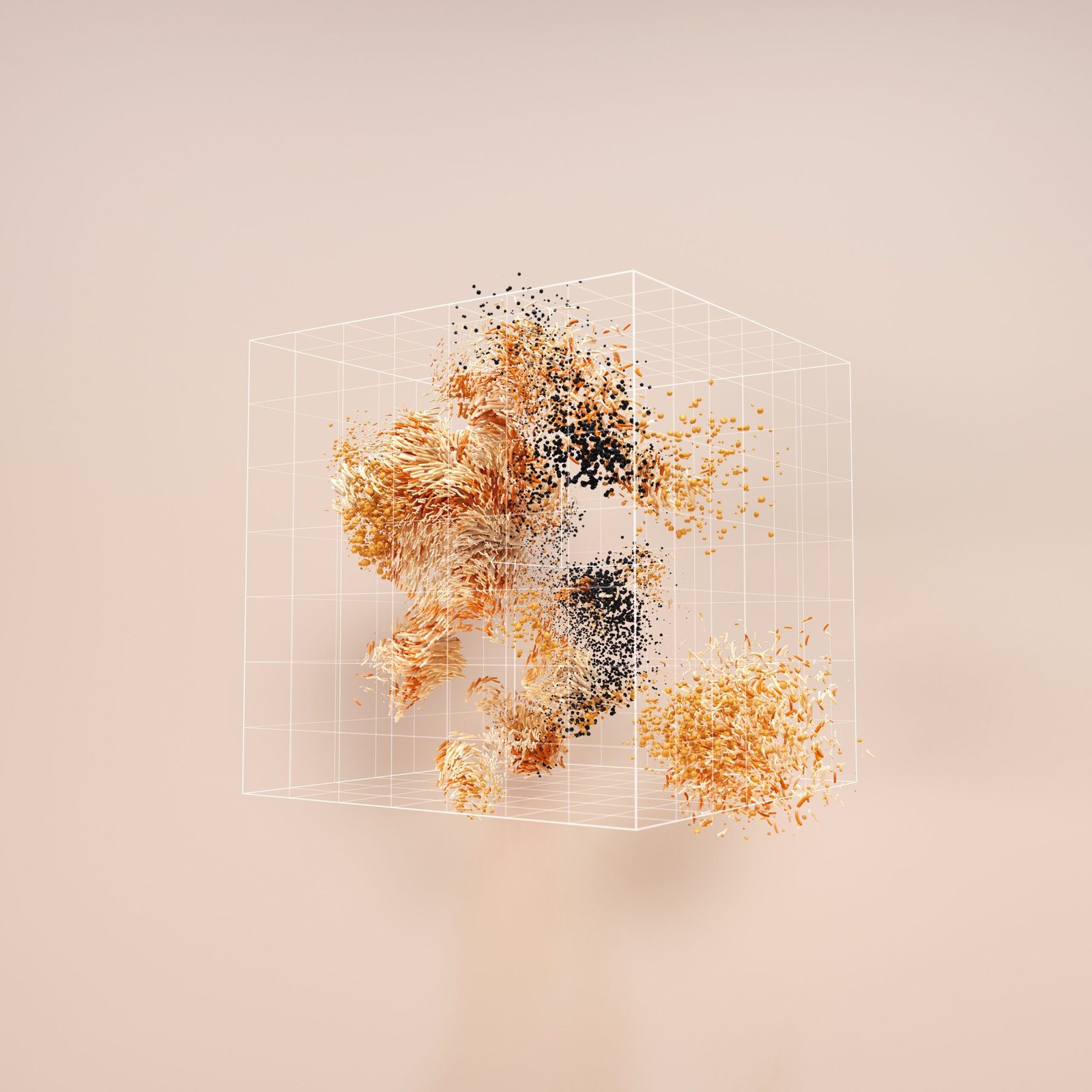

At the heart of cryptocurrencies lies blockchain technology. Here’s a deeper look at how it works:

- Decentralization: Blockchains are distributed ledgers maintained by a network of nodes (computers). Each node has a copy of the entire blockchain, ensuring transparency and security. Decentralization reduces the risk of a single point of failure.

- Blocks and Transactions: Transactions are grouped into blocks. Each block contains a cryptographic link to the previous block, forming an immutable chain. Once a block is added, it cannot be altered, ensuring data integrity.

- Consensus Mechanisms: Blockchains use consensus algorithms to validate transactions. Examples include Proof of Work (PoW) and Proof of Stake (PoS). Miners or validators compete to add new blocks to the chain, ensuring agreement on the state of the ledger.

Use Cases and Impact

- Financial Services: Cryptocurrencies enable faster, cheaper cross-border transactions. They also provide financial services to the unbanked population in developing countries. Stablecoins pegged to fiat currencies offer stability for everyday use.

- Supply Chain Management: Blockchain ensures transparency and traceability in supply chains. Companies can track products from origin to delivery, reducing fraud and ensuring product authenticity.

- Identity Management: Decentralized identity solutions allow users to control their personal data securely. Self-sovereign identity systems empower individuals to manage their digital identities without relying on centralized authorities.

- Tokenization: Real-world assets (such as real estate, art, or commodities) can be tokenized on blockchains. This fractional ownership increases liquidity and accessibility, democratizing investment opportunities.

Challenges and Future Trends

- Regulation: Governments worldwide are grappling with how to regulate cryptocurrencies. Balancing innovation with investor protection remains a challenge. Clear guidelines are essential for fostering responsible growth.

- Scalability: Blockchains face scalability issues. Solutions like layer-2 networks (such as the Lightning Network for Bitcoin) and sharding (for Ethereum) aim to enhance throughput without compromising security.

- Environmental Impact: PoW blockchains consume significant energy. Transitioning to more eco-friendly consensus mechanisms (like PoS or delegated PoS) is crucial for sustainability.

Conclusion

Cryptocurrencies and blockchain technology are reshaping the financial landscape. Whether you’re an investor, developer, or curious observer, understanding these concepts is essential. Stay informed, explore the evolving ecosystem, and keep an eye on this exciting space—it’s only just beginning! 😊

This page will refresh every 10 minutes.