Nvidia Surpasses Apple in Market Value: A Deep Dive

Photo by Annie Spratt on Unsplash

The recent surge in Nvidia’s market value has captured the attention of investors and analysts alike. Nvidia, renowned for its cutting-edge graphics processing units (GPUs), has experienced an unprecedented rise, eclipsing even Apple in market capitalization. This significant milestone is the culmination of a series of strategic decisions, robust financial performances, and favorable market sentiment.

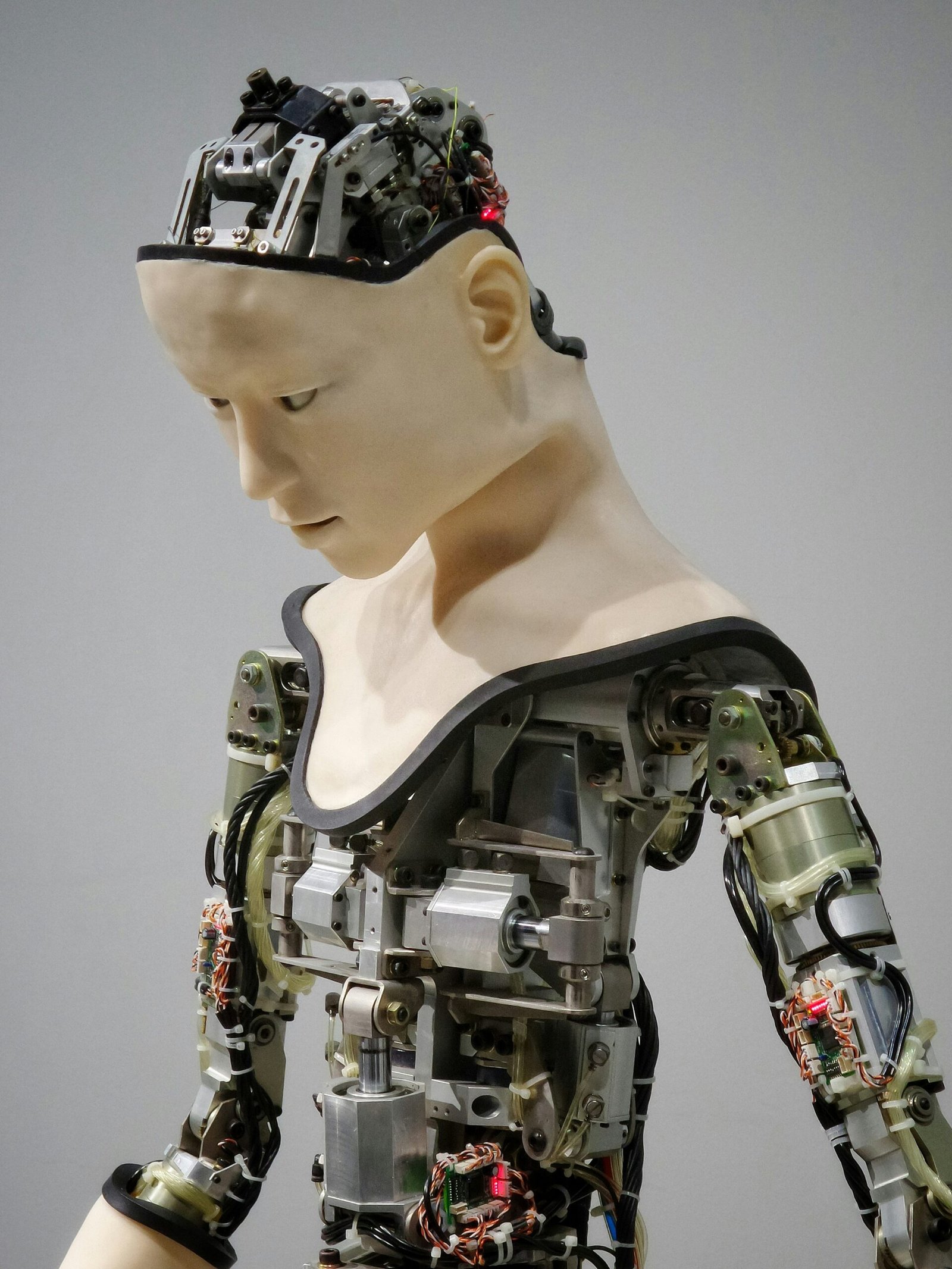

Over the past few years, Nvidia has strategically positioned itself at the forefront of several high-growth sectors, including artificial intelligence (AI), data centers, and autonomous vehicles. The company’s commitment to innovation and its ability to deliver high-performance computing solutions have been pivotal in driving its growth trajectory. Nvidia’s GPUs have become critical components in AI research and data processing, establishing the company as a leader in these transformative technologies.

Financially, Nvidia has reported impressive quarterly results, consistently exceeding market expectations. The company’s revenue and net income have shown robust growth, underpinned by strong demand for its products across various sectors. Nvidia’s strategic acquisitions, such as the purchase of Mellanox Technologies and ARM Holdings, have further expanded its technological capabilities and market reach, contributing to its overall growth narrative.

Market sentiment has also played a crucial role in Nvidia’s ascent. Investors have recognized the company’s potential to capitalize on emerging trends and have responded positively to its strategic initiatives. Nvidia’s stock has seen substantial appreciation, reflecting confidence in its long-term prospects. The alignment of technological advancements with market demands has positioned Nvidia as a pivotal player in the tech industry, driving its market value to unprecedented heights.

In summary, Nvidia’s surpassing of Apple’s market value is a testament to its strategic foresight, innovative prowess, and strong financial performance. The company’s ability to adapt and thrive in a rapidly evolving technological landscape underscores its remarkable growth and market dominance.

Historical Comparison: Nvidia vs. Apple

Over the past decade, Nvidia and Apple have exhibited remarkable growth trajectories, albeit through different market dynamics and strategies. Nvidia, primarily known for its powerful GPUs and advancements in AI technology, has seen a transformative rise in its market value. On the other hand, Apple, a titan in consumer electronics, has consistently expanded its ecosystem of products and services, maintaining its position as a market leader.

In 2013, Nvidia’s market capitalization was a fraction of Apple’s, with Apple valued at approximately $500 billion compared to Nvidia’s $10 billion. During this period, Apple’s iPhone revolutionized the smartphone industry, while Nvidia was laying the groundwork for its future dominance in the AI and gaming sectors.

Fast forward to 2016, Nvidia’s market value began to surge, thanks to its strategic investments in AI and data centers. The release of its Pascal architecture GPUs and the growing demand for high-performance computing fueled this growth. By contrast, Apple continued to innovate with the release of new iPhone models and the expansion of its service offerings, including Apple Music and Apple Pay.

Between 2019 and 2021, Nvidia’s stock experienced exponential growth, driven by the increasing adoption of AI, machine learning, and the booming gaming industry. During this period, Nvidia’s acquisition of Mellanox Technologies and its attempt to acquire Arm Holdings further strengthened its market position. Meanwhile, Apple continued to grow its market value, reaching a historic $2 trillion milestone in 2020, driven by strong sales of its iPhone, Mac, and services.

In 2023, Nvidia’s market value surpassed Apple’s, marking a significant milestone in the technology sector. This shift can be attributed to Nvidia’s dominance in the AI and data center markets, combined with its diversification into new areas such as autonomous vehicles and the metaverse. Apple’s steady growth, while impressive, was overshadowed by Nvidia’s rapid ascent.

The accompanying charts and graphs illustrate these growth patterns, highlighting the pivotal moments and strategic decisions that propelled Nvidia past Apple in market value. This historical comparison underscores the dynamic nature of the technology industry and the importance of innovation and strategic foresight.

Key Drivers Behind Nvidia’s Market Growth

Nvidia’s remarkable ascent in market value can be attributed to several key drivers, each of which has played a pivotal role in the company’s rapid growth. Central to this progress is the continuous advancement in GPU technology. Nvidia has consistently been at the forefront of graphic processing unit (GPU) innovation, with its latest architectures like Ampere and Turing setting new standards in performance and energy efficiency. These advancements have not only solidified Nvidia’s position in the gaming industry but have also opened new avenues in fields such as artificial intelligence (AI) and data centers.

Strategic acquisitions have also significantly bolstered Nvidia’s market position. The acquisition of Mellanox Technologies in 2020, for instance, has enhanced Nvidia’s capabilities in high-performance computing and data center networking. This move has allowed Nvidia to offer more comprehensive solutions to its customers and tap into the growing demand for data center services. Furthermore, the pending acquisition of Arm Holdings is poised to strengthen Nvidia’s foothold in the semiconductor industry, potentially revolutionizing the way processors are designed and utilized across various applications.

Expansion into AI and data centers has been another critical factor in Nvidia’s market growth. The company’s GPUs are now widely used in AI training and inference, which require immense computational power. Nvidia’s CUDA platform has become the go-to solution for researchers and developers in the AI community, driving substantial revenue growth. In the data center segment, Nvidia’s GPUs are crucial for tasks such as deep learning, analytics, and workload acceleration, further diversifying its revenue streams.

The impact of the gaming industry cannot be understated in Nvidia’s success story. The release of the GeForce RTX series, with real-time ray tracing capabilities, has set a new benchmark for gaming graphics. Major milestones, such as the launch of the RTX 30 series, have consistently driven consumer demand, solidifying Nvidia’s dominance in the gaming market. These product launches have not only boosted sales but also reinforced Nvidia’s brand as a leader in cutting-edge technology.

Overall, Nvidia’s market value surge is a culmination of its relentless innovation in GPU technology, strategic acquisitions, expansion into AI and data centers, and a strong presence in the gaming industry. Each of these elements has contributed to creating a robust and diversified business model that continues to propel the company forward.

Apple’s Market Position and Challenges

Apple Inc. has long been a dominant player in the global tech market, renowned for its innovative products and strong brand loyalty. However, despite its established market position, Apple faces several challenges that have impacted its market value. One of the primary issues is market saturation. The smartphone market, which has been a significant revenue driver for Apple, is nearing saturation in many developed regions. This saturation has led to slower growth rates, making it increasingly difficult for Apple to maintain its previous momentum.

Additionally, competition in the tech industry has intensified. Rivals such as Samsung, Google, and emerging Chinese manufacturers like Huawei and Xiaomi are continually launching competitive products, putting pressure on Apple’s market share. These competitors invest heavily in research and development, often introducing features and innovations that rival or outpace those of Apple’s offerings.

Another critical factor is the innovation cycle. While Apple is known for its groundbreaking products, the intervals between significant innovations have lengthened. Consumers and investors have raised concerns about the company’s ability to consistently deliver revolutionary products, impacting market confidence. The reliance on iterative updates to existing product lines, rather than groundbreaking new devices, has been a point of contention among critics and market analysts.

Recent setbacks have also played a role in Apple’s market value trajectory. For instance, supply chain disruptions, partly due to global semiconductor shortages and geopolitical tensions, have affected product availability and delivery timelines. Furthermore, regulatory scrutiny in various regions, including antitrust investigations and privacy concerns, has posed additional challenges for the company.

These factors collectively contribute to the slower growth in Apple’s market value compared to Nvidia. While Apple continues to be a formidable force in the tech industry, addressing these challenges will be crucial for the company to regain its competitive edge and sustain its market leadership.

Impact of Global Market Trends

The global market trends have played a pivotal role in shaping the market values of Nvidia and Apple, significantly influencing their financial trajectories. A key driver has been the meteoric rise of artificial intelligence (AI). Nvidia, with its robust portfolio of AI-driven technologies, has capitalized on this trend, offering cutting-edge graphics processing units (GPUs) that are integral to AI applications. The demand for high-performance computing and machine learning capabilities has surged, positioning Nvidia as a leader in the AI domain and boosting its market value.

Conversely, Apple, while also making strides in AI, primarily through its innovations in Siri and other smart technologies, has not seen the same level of market value growth directly tied to AI advancements. The company’s focus remains diversified across consumer electronics, software, and services, which has provided a steady revenue stream but has not matched the explosive growth seen in Nvidia’s AI-centric ventures.

Another significant trend impacting both companies is the ongoing semiconductor shortage. This global crisis has disrupted supply chains across various industries, including consumer electronics and computing. Nvidia, a key player in the semiconductor market, has faced challenges in meeting the growing demand for its products. However, this scarcity has paradoxically driven up the value of its existing inventory and future production capabilities, contributing to its rising market valuation.

Apple, on the other hand, has experienced supply constraints that have affected its production schedules and product availability. While Apple’s strong brand loyalty and diversified product range have mitigated some of the adverse impacts, the scarcity of semiconductors has nonetheless posed significant challenges, affecting its market performance.

Changing consumer behaviors have also influenced the market dynamics for both companies. The shift towards remote work and digital transformation has heightened the demand for advanced computing solutions, benefiting Nvidia’s market position as a provider of high-performance GPUs. Apple, although benefiting from increased sales of its MacBooks and iPads, has not seen the same exponential growth in market value as Nvidia. The consumer shift towards AI-driven technologies and the broader digital ecosystem continues to favor Nvidia’s market trajectory.

Investor Sentiment and Market Reactions

Nvidia’s unprecedented rise in market value, surpassing tech giant Apple, has evoked significant reactions from investors and market analysts alike. This milestone reflects a shift in investor sentiment, with Nvidia’s stock price experiencing substantial upward momentum. Market experts attribute this growth to Nvidia’s leadership in advanced technologies, such as artificial intelligence and graphics processing units, which are increasingly critical in the evolving tech landscape.

Analysts have pointed to several factors driving Nvidia’s valuation surge. The company’s strategic investments in data centers, autonomous vehicles, and gaming have positioned it as a key player in multiple high-growth sectors. This diversification not only mitigates risks but also enhances investor confidence, as Nvidia remains less dependent on any single market segment. Consequently, Nvidia’s stock price has shown resilience and robust performance, attracting a swarm of institutional and retail investors.

In contrast, Apple’s market standing, while still formidable, has encountered challenges. The saturation of the smartphone market and heightened competition in consumer electronics have exerted pressure on Apple’s growth trajectory. Market analysts note that although Apple continues to demonstrate strong financial health and innovation, the pace of its growth appears to be stabilizing compared to the explosive potential seen in Nvidia. This comparative outlook has led some investors to recalibrate their portfolios, favoring Nvidia’s shares for their growth potential.

The broader financial community’s perspective underscores a growing confidence in Nvidia’s long-term prospects. Investor sentiment is buoyed by Nvidia’s consistent performance and visionary leadership, which are seen as pivotal in sustaining its competitive edge. Market reactions, evidenced by bullish stock price movements and increased trading volumes, reflect an optimistic outlook on Nvidia’s future. This sentiment is further reinforced by endorsements from prominent market analysts who have revised their price targets upwards, signaling strong market faith in Nvidia’s continued ascendancy.

Future Outlook for Nvidia and Apple

The future outlook for Nvidia and Apple is shaped by a combination of current trends, market forecasts, and strategic initiatives undertaken by both companies. Nvidia, having recently surpassed Apple in market value, stands at a pivotal point where its growth trajectory could be significantly influenced by several key factors.

For Nvidia, the primary growth areas include artificial intelligence (AI), data centers, and the automotive industry. The company’s advancements in AI technology are set to drive demand in various sectors, including healthcare, finance, and technology. Nvidia’s GPUs are increasingly being used for AI workloads, which positions the company favorably in a rapidly expanding market. Moreover, Nvidia’s data center business continues to grow, fueled by the increasing need for cloud computing and data processing. The demand for high-performance computing solutions is expected to rise, providing Nvidia with ample opportunities for expansion. Additionally, Nvidia’s foray into the automotive industry, particularly with its autonomous driving technology, could open new revenue streams as the industry evolves.

On the other hand, Apple’s future prospects are closely tied to its ability to innovate and adapt to changing consumer preferences. The company has consistently demonstrated a capacity for innovation, with upcoming product releases such as new iterations of the iPhone, advancements in wearables, and potential expansions into augmented reality (AR) and virtual reality (VR). Apple’s ecosystem, which integrates hardware, software, and services, continues to be a significant competitive advantage. The company’s services segment, including Apple Music, Apple TV+, and the App Store, is expected to contribute increasingly to its revenue, offsetting potential slowdowns in hardware sales.

Both Nvidia and Apple are also focusing on sustainability and environmental initiatives, which are becoming increasingly important to investors and consumers alike. Nvidia’s commitment to energy-efficient computing and Apple’s efforts to reduce carbon emissions throughout its supply chain are likely to enhance their respective brand reputations and appeal.

In conclusion, while Nvidia’s market value has surged past Apple’s, the future outlook for both companies remains robust. Nvidia’s advancements in AI, data centers, and autonomous driving technology, coupled with Apple’s innovation in consumer electronics and services, suggest that both companies are well-positioned to continue their growth trajectories in the coming years.

Conclusion: What This Means for the Tech Industry

The historic moment of Nvidia surpassing Apple in market value marks a significant turning point in the tech industry. This development highlights the growing importance of specialized technology sectors, particularly those focused on artificial intelligence and high-performance computing. Nvidia’s success can be attributed to its strategic investments in emerging technologies, robust R&D efforts, and a visionary approach to market needs. The company’s rise underscores the increasing value placed on innovation that extends beyond traditional consumer electronics.

For the broader tech industry, Nvidia’s achievement serves as a compelling case study in adaptability and foresight. Companies within the sector must recognize the importance of diversifying their portfolios to include next-generation technologies. This shift not only mitigates risks associated with market saturation but also opens up new avenues for growth and revenue. The emphasis on AI, machine learning, and data-centric applications is expected to intensify, prompting other tech giants to re-evaluate and possibly re-align their strategic priorities.

The implications of Nvidia’s market ascendance are vast. It signals a potential shift in market dynamics where companies excelling in niche, high-demand technologies can achieve unprecedented valuations. This could lead to increased investments in sectors such as quantum computing, autonomous vehicles, and advanced graphics processing, driving further innovation and competition. Additionally, Nvidia’s journey offers valuable lessons on the importance of agility, continuous learning, and the willingness to invest in cutting-edge research.

In summary, Nvidia’s milestone is not just a testament to its success but also a harbinger of future trends in the tech industry. As market leaders and emerging players alike look to emulate this achievement, the industry can expect a wave of technological advancements and possibly a redefinition of market leadership. This new paradigm underscores the critical importance of innovation, making it clear that the future belongs to those who are willing to push the boundaries of what technology can achieve.